4 Direct Mail Tactics to Boost Insurance Customer Acquisition

Each year, insurance premiums written in the U.S. exceed one trillion dollars. Yet, it’s rare for consumers to self-identify the need for insurance products due to a lack of awareness, perceived complexity, optimism bias, and even trust. This presents a unique challenge for insurance marketers striving to reach their growth goals. Since organic lead generation is low, many marketers leverage direct mail tactics to boost insurance customer acquisition.

Direct mail captures prospects’ attention, and its long-form format is excellent for educating prospects on the benefits of insurance protection, building trust, and driving conversions.

|

Prefer to listen? Check out our podcast The Direct Effect: Direct Mail Tactics to Boost Insurance Customer Acquisition |

Why Direct Mail is Effective for Insurance Customer Acquisition

The insurance industry continues to lead in direct mail volume. Marketers leverage direct mail tactics to boost insurance acquisition because mail attracts and converts new customers unlike any other channel. In 2024, insurance marketers allocated 44.7% of their direct mail budgets toward customer acquisition, and in the next twelve months, 57% say they will increase their mail budgets even more.

Insurance is Personal. Your Marketing Should Be Too.

Insurance is an incredibly personal product. Therefore, your insurance direct marketing should be personalized to each prospect.

Insurance companies can utilize the information they already have with their policyholders to create a personalized acquisition strategy. Start by mapping out customer journeys that align with your insurance products, such as life changes that present opportunities for new customers. Then, identify customer signals through behavioral data analysis to trigger targeted messaging. For example, actions like visiting a real-estate website, reading about supplemental life insurance, or completing an online form can prompt a series of personalized mail pieces with recommendations based on their cues.

Tips for personalized direct mail:

- Use customer data to tailor messages to individual needs.

- Include personalized offers based on prospect behavior.

- Design visually appealing and relevant content.

- Incorporate a clear call to action.

- Coordinate your mail with complementary digital marketing efforts.

Target the Best Prospects for Your Products

One-size-fits-all insurance products are a thing of the past, as are lists built off rough demographics and zip codes.

Insurance marketers can use audience segmentation and predictive modeling to create subgroups based on their best policyholders’ shared behaviors, interests, or attributes. This ensures your mailing lists are focused on the most receptive and valuable prospects, avoiding the pitfalls of broad targeting, which can dilute the impact of campaigns and waste budget. High-quality data drives accurate and effective audience segmentation and sets your direct mail acquisition campaign up for future scale.

Direct mail data can come from various sources. It’s crucial to ensure that any data you (or your partners) use for audience building is collected and shared with proper consent and complies with privacy laws.

How to segment your audience:

- Demographic: age, gender, income, education, marital status.

- Geographic: counties, states, counties, cities, towns.

- Psychographic: personality, attitude, values, interests.

- Technographic: device, app, software usage.

- Behavioral: tendencies, actions, product use, purchasing habits.

- Needs-based: product or service must-haves.

- Value-based: economic value to your company.

Use your Creative Strategy to Engage and Acquire

Marketing in the insurance industry is highly regulated to protect consumers. Therefore, insurance marketers must be diligent about producing complaint advertisements that other industries may not.

While the core direct mail creative elements still apply; strong call to action, compelling offer, bold headlines, clear and simple messaging, professional imagery, constant branding, etc., other direct marketing strategies do not. In insurance marketing, it’s critical to evoke the right emotions by focusing on the value and benefits of your products rather than using fear tactics. Lead with the value of your offerings before mentioning any limitations to help customers see the benefits first. Highlight how your insurance solutions address customer pain points and answer the question, “What’s in it for me?”

Types of insurance offers that work well:

- Personalized policy recommendations based on customer data

- Discounted premiums for new customers

- Bundled insurance packages

- Loyalty rewards for long-term policyholders

- Limited-time offers for specific coverage

When we asked insurance marketers what types of direct mail offers work best, 40% indicated a percentage discount performed better than a specific dollar amount or a free gift.

Blend Direct Mail with Digital Advertising to Boost Conversions

It’s no secret that integrated direct marketing campaigns can increase reach, conversions, and return on investment. Yet, nearly one in four insurance marketers admit integration complexity is the top challenge of the direct mail channel.

Today’s consumers expect a multichannel experience. When paired with digital advertising, mail enforces the campaign’s message and builds on consumer trust, while a coordinated social media campaign can humanize your brand and boost credibility over your competitor.

Best practices for integrating direct mail and digital campaigns:

- Onboard your direct mail list into digital environments for an accurate and targeted campaign. This will protect your ad budget from wasted spend on generic audiences or fraud bots.

- Schedule your direct mail and digital campaigns to complement each other. For example, touch your audience with a display ad prior to the mail’s in-home date, then follow up with an email after the piece is delivered.

- Ensure your digital advertisement branding and messaging is consistent with your direct mail piece. 100% of insurance marketers indicated that a landing page that is consistent with the direct mail creative results in more conversions.

- Make the most of the USPS Integrated Technology Promotions. This program offers discounts for brands that blend technology into direct mail.

- Use unique promo codes, TFNs, or URLs to track responses from different channels and perform a match-back analysis. Leverage a holdout group to calculate the incremental sales rate and lift offered by mail.

Partner with SeQuel Response to Boost Insurance Customer Acquisition.

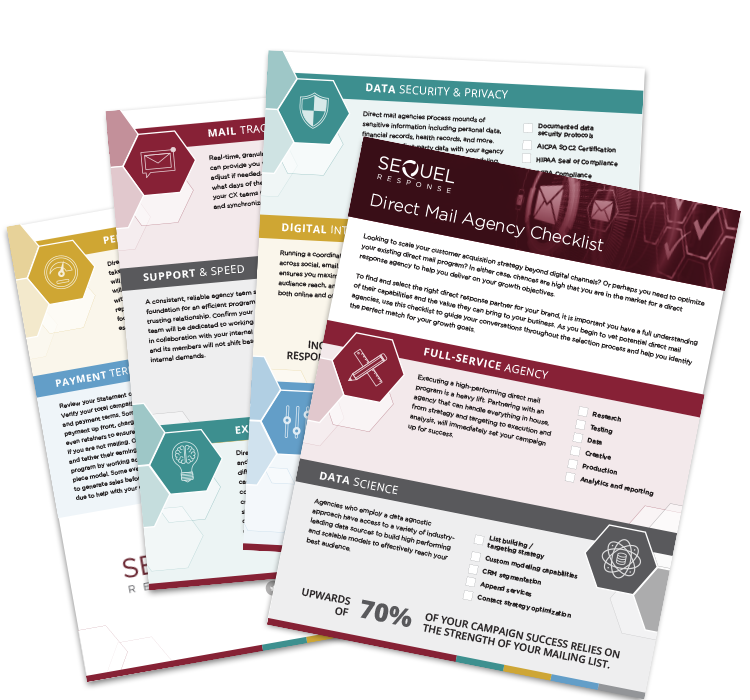

This tactic is not technically included in our list, but it is something to consider. Partnering with an experienced direct mail agency can give you the expertise and resources you need to plan and execute a successful acquisition campaign within your budget.